The $50,000 Question Nobody Wants to Answer

Rachel invested $10,000 in a mutual fund in January. By December, it was worth $11,200. She was furious.

Her colleague Tom put the same amount in the same fund. By December, his was also worth $11,200. He was thrilled.

Same fund. Same return. Same 12% gain. Two completely different reactions.

The mutual fund didn’t fail anyone. But one person’s expectations did.

This is the secret that the financial industry doesn’t talk about: mutual funds work exactly as designed. The problem is, most people don’t know what they’re actually designed to do.

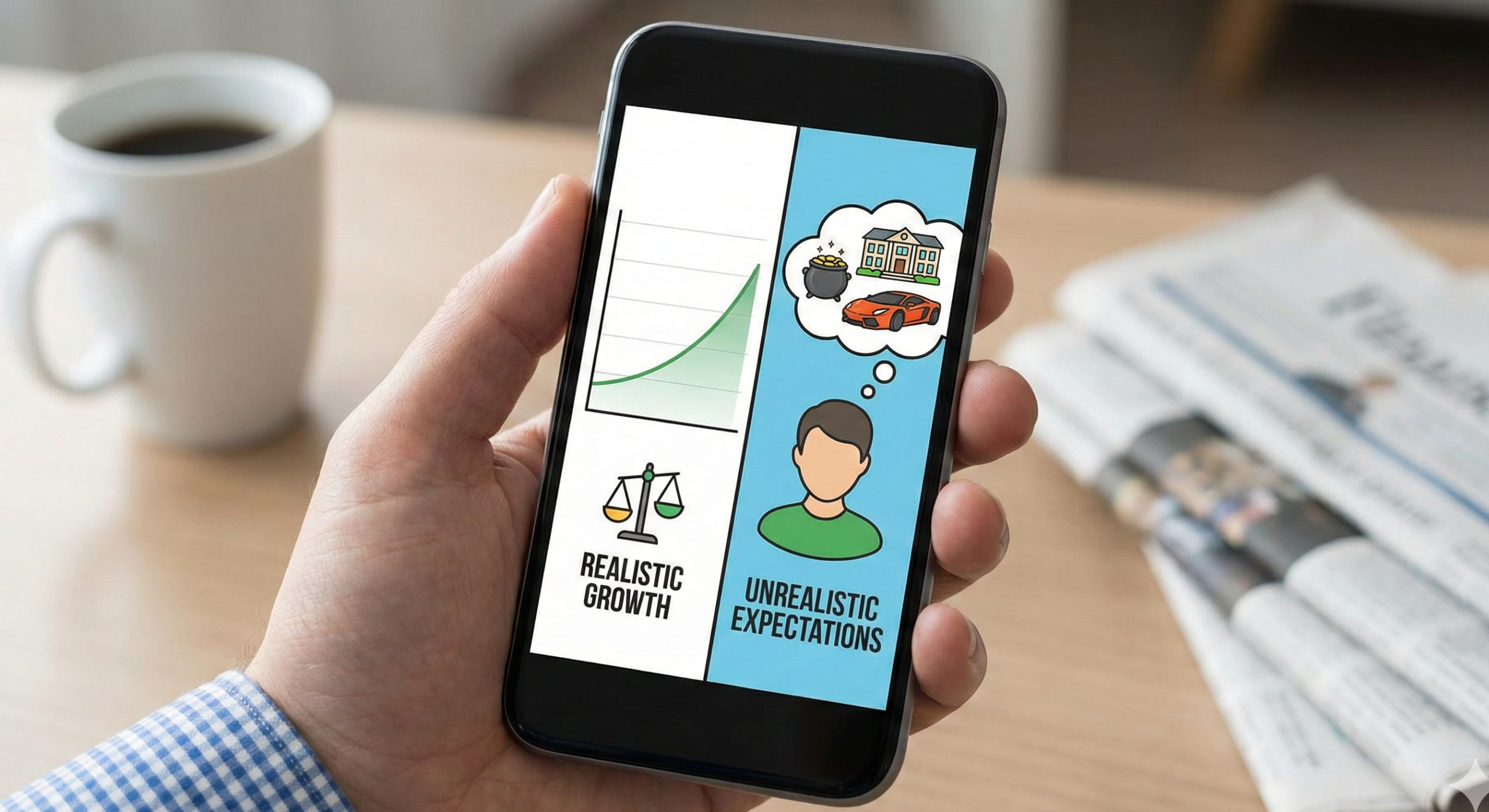

The Fantasy vs. The Reality

Let’s start with what you probably think mutual funds should do:

You imagine handing over your money and watching it multiply rapidly. Double in three years. Triple in five. Retire early. Sip cocktails on a beach while your fund manager works magic.

Here’s what mutual funds actually do:

They pool your money with thousands of other investors, spread it across dozens or hundreds of companies, charge you a small fee, and deliver returns that roughly match the market. Some years up 20%. Some years down 15%. Over decades, maybe 8-10% annually if you’re lucky.

Not sexy. Not exciting. Not Instagram-worthy.

But it works.

Why Your Expectations Are Sabotaging You

Expectation #1: “My fund should beat the market”

Most actively managed funds don’t beat the market. Not because fund managers are incompetent, but because beating the market consistently is nearly impossible after accounting for fees and taxes.

Study after study shows that 80-90% of active fund managers underperform their benchmark over 15 years. The ones who do win? Often different managers each time. Past performance predicts almost nothing.

Yet investors keep chasing last year’s winners, convinced this time will be different. It rarely is.

Expectation #2: “I should see steady growth every year”

Markets don’t move in straight lines. They zigzag, plateau, crash, and soar. A mutual fund invested in stocks will do the same.

In 2008, the average equity mutual fund dropped 38%. In 2009, it gained 27%. In 2022, down 18%. In 2023, up 24%.

If you expect smooth, predictable gains, you’re expecting something that has never existed and never will. The volatility isn’t a bug—it’s literally how markets work.

Expectation #3: “The fund manager knows something I don’t”

Fund managers have access to research, data, and analysis tools you don’t. But so do thousands of other fund managers, all competing against each other.

That “edge” disappears the moment everyone has it. Markets are efficient enough that most information is already priced in by the time you hear about it.

Your fund manager isn’t a fortune teller. They’re making educated guesses just like everyone else, only with fancier spreadsheets and bigger fees.

Expectation #4: “I can time when to buy and sell”

You think you’ll buy low and sell high. In reality, most investors do the opposite.

They pour money into funds after great years (buying high) and panic-sell after bad years (selling low). Then they blame the fund for “not working.”

The fund didn’t fail. Your timing did.

Expectation #5: “Higher fees mean better performance”

Surely that fund charging 2% annually must be better than the one charging 0.2%, right?

Wrong. Higher fees are one of the most reliable predictors of lower returns. Every rupee, dollar, or euro you pay in fees is one less unit compounding for you over decades.

A 1.5% difference in fees can cost you hundreds of thousands over a 30-year investment period. But it feels insignificant year-to-year, so people ignore it.

The Expectations That Actually Work

So what should you expect from mutual funds?

Expect average returns. The market averages around 10% annually over long periods (including dividends). Your fund will probably deliver something close to that, minus fees. Accept it.

Expect volatility. Some years will be great. Some will be terrible. Most will be somewhere in between. This is normal, not a crisis.

Expect to do nothing. The less you tinker, trade, and “optimize,” the better you’ll probably do. Boring persistence beats clever activity.

Expect fees to matter. Choose low-cost index funds unless you have a compelling reason not to. Every percentage point matters over decades.

Expect decades, not months. Mutual funds are long-term tools. If your timeline is less than five years, you’re using the wrong investment vehicle.

The Harsh Truth About Disappointment

Here’s what nobody wants to hear: if you’re disappointed with your mutual fund, the problem is probably you.

Not because you’re dumb or bad at investing, but because somewhere along the way, someone sold you a fantasy. A guru promised easy wealth. A financial advisor made it sound simpler than it is. An advertisement showed happy retirees who “did everything right.”

Mutual funds can’t deliver on fantasies. They can only deliver market returns, minus costs, over time.

When you understand that—really understand it—disappointment evaporates. You stop checking your balance every week. You stop comparing yourself to the one guy who got lucky with crypto. You stop feeling like you’re missing out.

You just keep investing, month after month, year after year. And decades later, you look back and realize the “boring” approach worked exactly as promised.

Reset Your Expectations, Change Your Results

The most successful mutual fund investors aren’t the smartest or the wealthiest. They’re the ones with realistic expectations.

They know markets fluctuate. They accept average returns. They minimize fees. They invest consistently. They wait patiently.

That’s it. No secret formula. No insider knowledge. Just aligned expectations and disciplined execution.

Mutual funds don’t fail people. People fail themselves by expecting magic when they should be expecting mathematics.

Lower your expectations from “get rich quick” to “build wealth steadily,” and suddenly your mutual fund isn’t failing you anymore.

It’s doing exactly what it was designed to do.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Consult a qualified financial advisor before making investment decisions. FOLLOW FOR MORE..